In today’s time, an education loan has become an important means for obtaining higher education. It proves to be a boon for students who are unable to continue their studies due to financial constraints. However, it is also very important to repay an education loan on time. Failing to make timely repayments can have negative consequences, as you may incur additional interest charges and fees. If you do not have sufficient funds to repay the loan, you can opt for a loan settlement. Loan settlement means fully repaying the education loan taken from a bank or financial institution.

The education loan settlement process can be challenging for students and their families, as it involves various financial and legal aspects. During loan settlement, you must follow different procedures and terms to ensure that you do not face any issues in the future.

It is possible to settle your education loan because it is an unsecured loan, which allows you to stop repayments and negotiate a settlement with the bank. This is different from other loans, such as a home loan or car loan, which require collateral or security. Education loan settlement does not require any such collateral. To proceed with an education loan settlement, it is necessary to communicate and negotiate with your bank.

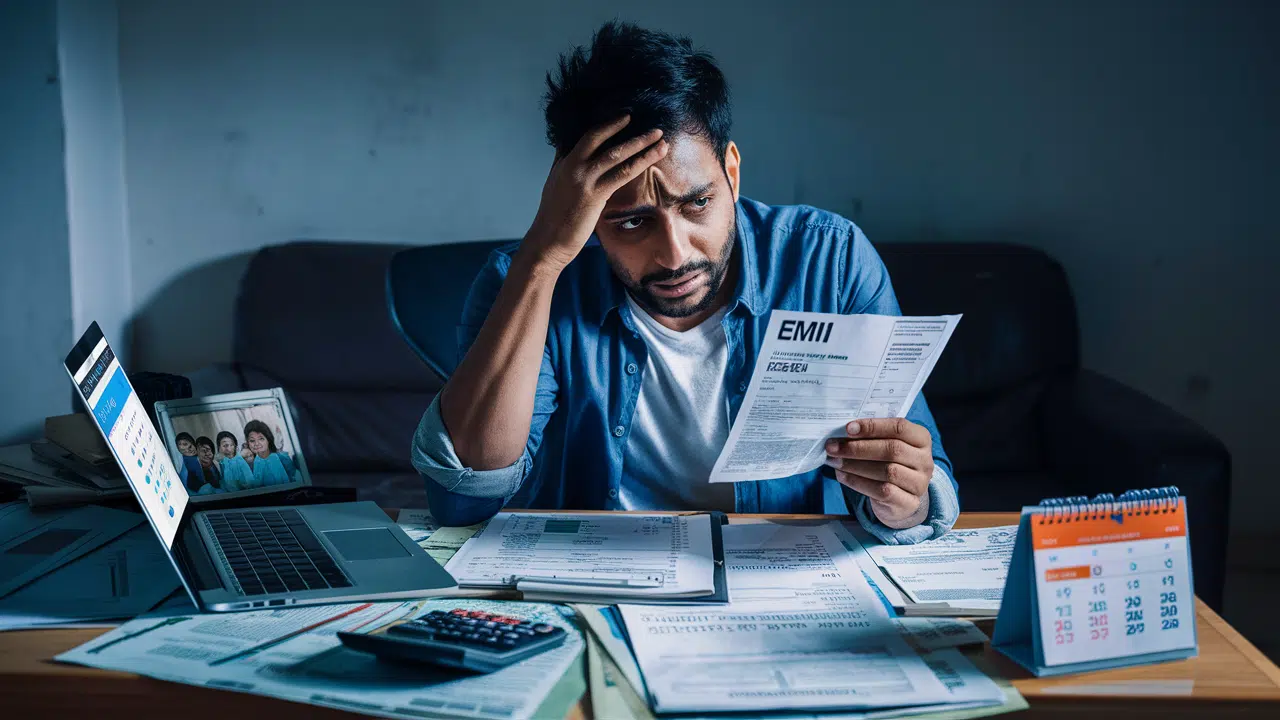

If you are unable to pay the monthly installments of your education loan, contact your bank as soon as possible and explain why you are unable to make the payments. Missing the repayment schedule may result in additional fees on top of your monthly EMI. If you continue to miss payments for several months, the bank may also declare you a defaulter. To avoid all these issues, you should consider an education loan settlement.

Before opting for a loan settlement, it is very important to understand your options and challenges. If you decide to settle your education loan, there are generally two common ways to repay it: a lump sum payment or monthly installments.

If you cannot pay the full amount, you can opt for a One-Time Settlement (OTS). This can be a necessary and effective option. Loan settlement can benefit both parties: the bank receives a portion of the outstanding loan amount, and you can repay your loan quickly and free yourself from the burden of debt.

If you choose the monthly installment option for loan settlement, you make smaller payments over a longer period. While this may seem more affordable and convenient for you, it is generally less beneficial for banks compared to a one-time settlement.

If you decide to settle your education loan, there are a few things to keep in mind during the process. The first and most important step is to gather all your financial data and make a list. This will help you in arranging a loan settlement.

To settle your education loan, communicate with your bank and present a settlement proposal. Be confident during negotiations and request a settlement for a lower amount. Loan settlement requires bargaining with the bank, and only then can you settle your loan for a reduced amount. Finally, remain patient and persistent. You may need to make several attempts with the bank, but eventually, they are likely to accept your proposal.

If you are unsure how to proceed with an education loan settlement, you can avail of our services. We help settle your loan for the lowest possible amount and reduce your financial burden.

Settling an education loan can offer several advantages. By repaying your loan early, you can save money for your retirement, and if you have taken a home loan, you can also save more funds for its repayment. Education loan settlement helps you save money significantly. Through loan settlement, you can pay less than the total outstanding amount and receive a discount on your entire loan balance.

If you are unsure where to start to get relief from your loan burden, you can seek assistance from ahktips.com. We are experts in negotiating settlements with banks and helping people get out of debt traps. Although our services involve a fee, we can help settle your loan for as low as 30% of the total amount.

If you use our services, we reduce your loan recovery burden and also respond to all legal notices sent by the bank on your behalf. If you want more information about our services, you can contact us anytime.

If you need help with education loan settlement, Ahk Tips is here to assist you. Regardless of your financial situation, we can negotiate the best possible settlement for you. If you use our services, we can complete your settlement within 5–6 months. For larger loan amounts, the process may take up to a year. If you are troubled by recovery calls or harassment from recovery agents, you can apply for our services now and get relief from your loan burden as soon as possible.

Education Loan Settlement

Loan settlement is an important solution for individuals facing financial crises. It provides an opportunity to reduce the outstanding loan and free oneself from the burden of repayment. However, this process is not easy and requires patience, dedication, and a clear strategy.

Through education loan settlement, you can gain relief by paying around 25%–30% of your loan. It is essential to negotiate with your bank and understand their proposals. It is also important to note that banks and NBFCs approve settlements while protecting their own interests, so you must present a solid proposal based on your financial situation.

Our advisory services are always ready to guide you through this complex process. We will evaluate your options and, considering your financial situation, help you find the best solution. Our experts will negotiate with the bank on your behalf and strive to secure the settlement for the lowest possible amount.